Monthly New Features Highlights – January 2023

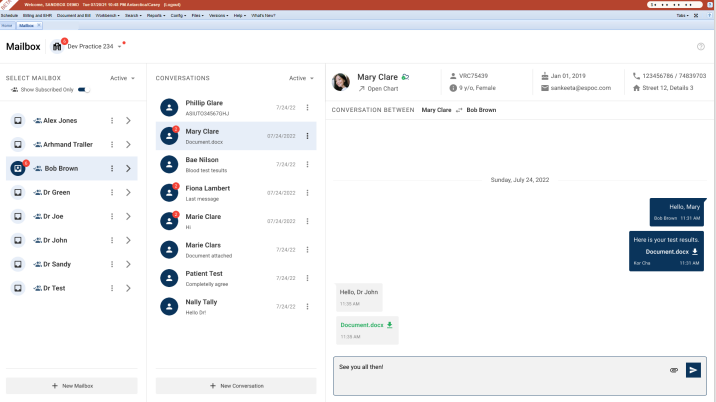

Production servers now offer several new features. The Patient Messages Mailbox enhances patient communication and experiences. Automatic Document Publishing allows documents to be shared on the patient portal based on appointments. Patient phone numbers can be encoded as barcodes. Patient statements now offer the option to display the date of birth. XDocs Macro Management simplifies macro renaming and management. Flexnote has improved visibility for salted values and a new option for addendums.

Taking Your Private Practice to the Next Level with a Website

Creating a website for your private practice is crucial. To make it an effective marketing tool, ensure you have essential pages like the homepage, about, and contact pages. Target local keywords with dedicated service pages for various treatments and locations served. Develop a strong call-to-action landing page to enhance conversion rates. Link to social media pages and offer an email newsletter to capture leads. Invest in content marketing by adding a blog section and keep your site updated regularly for maximum impact.

Promoting Your Private Practice with Social Media

Social media offers a valuable platform for healthcare practitioners to cultivate relationships, showcase values, and validate expertise. It can serve as an excellent recruitment tool to attract top talent. Employ organic strategies like using hashtags, posting original photos, and planning content in advance. Paid social media strategies can grow your following and drive website traffic, but they require research and adherence to best practices. Developing a strong social media presence takes time, effort, and consistency.

Navigating Self-Employment Taxes and Other Tax Issues for Private Practices

Understanding the tax implications of running a private practice is crucial for managing your finances effectively. Self-employment tax, payroll tax, and corporate tax are key considerations. It’s important to budget for self-employment tax, make quarterly estimated payments, and outsource payroll tax management for convenience. Additionally, explore deductions like the QBI deduction, professional organization fees, educational expenses, software costs, and office expenses to optimize your tax strategy. Consulting a tax advisor for guidance is advisable.